If unspecified you should assume an annuity is an annuity due. Dividends are best defined as.

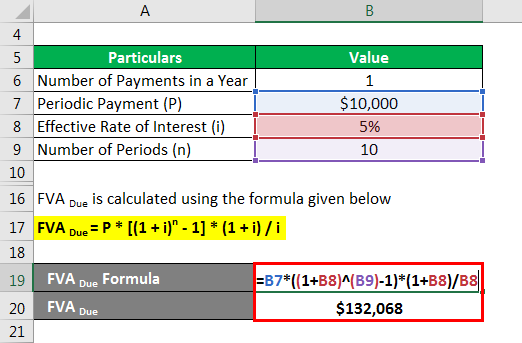

Future Value Of An Annuity Formula Example And Excel Template

His car payments can be described by which one of the following terms.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

. Classification of the Annuitys Owner as a Trust When the owner of a nonqualified annuity is a non-natural person such as a trust it is taxed on an annual basis and is ineligible for tax deferral benefits. The present value of an annuity is equal to the cash flow amount divided by the discount rate. A non-qualified annuity is funded with post-tax dollars.

Annuity one is an annuity due and the third investment is a perpetuity. The future value of an annuity decreases as the interest rate increases. Annuity B has both a higher present value and a higher future value than Annuity A.

The present value of Annuity A is equal to the present value of Annuity B. The annuity due has payments that occur at the beginning of each time period. The future value of an annuity decreases as the interest rate increases.

An annuity is an unending stream of equal payments occurring at equal intervals of time. Cash or stock payments to shareholders. A large corporation pension plan purchased an accumulation annuity contract where all of the participating employees received certificates of participation.

What is the anticipated dividend for Year 3 if the firm increases its dividend by 3 percent annually. What Is a Qualified Annuity. The present value of an annuity is equal to the cash flow amount divided by the discount rate.

Which one of the following statements is correct given these three investment options. AWeekly grocery bill BClothing purchases CCar repairs Correct DAuto loan payment EMedical bills Answer Key. Surrender charges assessed to the annuity owner following a withdrawal or surrender will not qualify as a loss under this ruling.

These are the homework questions for Chapter 5 in Corporate Finance. Travis is buying a car and will finance it with a loan which requires monthly payments of 265 for the next 4 years. The annual income of the buyer of an annuity is relevant to the suitability of that contract for several reasons.

Typically you can invest in a qualified annuity through your employers retirement plan or a traditional IRA. An annuity due has payments that occur at the beginning of each time period. Which one of the following qualifies as an annuity payment.

Annuity B will pay one more payment than Annuity A will. An annuity which starts paying monthly benefits within a month after issuance is called a n a. 40 Points Which one of the following qualifies as an annuity.

A trivia quiz on annuities. Far West Trading expects to pay an annual dividend of 175 per share next year. The present value of an annuity is equal to the cash flow amount divided by the discount rate.

Annuity A has a higher future value but a lower present value than Annuity B. An annuity due has payments that occur at the beginning of each time period. Test out what more you know.

If unspecified you should assume an annuity is an annuity due. Which one of the following statements concerning annuities is correct. The following are qualified plans.

The future value of Annuity A is greater than the future value of Annuity B. The ordinary annuity would be more valuable than the annuity due if both had a life of 10 years. If your annuity starting date was between July 1 1986 and November 19 1996 you were able to elect to use the Simplified Method or the General Rule.

If unspecified you should assume an annuity is an annuity due. If the contract is a flexible premium one contemplating ongoing. The future value of an annuity decreases as the interest rate increases.

D Upload your study docs or become a. A qualified annuity differs from a non-qualified annuity in that it is funded by pre-tax dollars. A qualified annuity is a retirement savings plan that is funded with pre-tax dollars.

The future value of an annuity decreases as the interest rate increases. Create your own Quiz. Qualified annuity contributions depend on your income and eligibility for other qualified retirement plans.

There are different ways that people choose to invest their income and annuities are perfect answer to people who do not want to risk lacking income as they ensure after one has made their premiums they get their cash back with interest or as original based on the annuity one chooses over a period of time. An annuity due has payments that occur at the beginning of each time period. To be the perpetuity the payments must occur on the first day of each monthly period.

This choice is irrevocable and applied to all later annuity payments. Which one of the following qualifies as an annuity payment.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

0 Comments